Are You in Urgent Need to Loan but Confused about How to Get It? Well Don’t Worry, In this Article, we have shared a List of RBI Approved Loan Apps in India that Provides Loan Instantly.

In Todays Fast Paced world, No One Has time to visit a bank, Stand in a Long queue for Hours, or fill out Multiple Forms to Get Loans. Thanks to the Neo banks and Digital Wallets, now getting Loan Has Become very convenient.

The need for a personal loan can arise suddenly due to various reasons like Emergency medical expenses, education expenses of a Child, To Start a New Business, or Travel and vacations. Therefore these Loan Apps can be helpful to get Instant loans without hassle or delay.

But the Real Question arises are these apps Safe to use? How to Identify Fake Loan apps which Apps are Approved by RBI and What are the Eligibility Criteria to Get Loan for These Apps? In this Detailed Article, We will Try to Answer Your all queries Including the Top RBI Approved Loan Apps in India.

50 RBI Approved Loan Apps in India

| RBI Approved Loan Apps in India | Credit Limit |

| Paytm Personal Loan | Upto 3,00,000 INR |

| Money Tap Loan | Upto 5,00,000 INR |

| Navi | Upto 5,00,000 INR |

| Paysense | Upto 5,00,000 INR |

| Lazy Pay | Upto 1,00,000 INR |

| Mi Credit Loan | Upto 2,00,000 INR |

| Dhani Loan App | Upto 5,00,000 INR |

| Avail Finance | Upto 50,000 INR |

| NIRA Instant Loan | Upto 2,00,000 INR |

| IDFC First Bank | Upto 1 Crore INR |

| Simpl | Upto 25000 INR |

| Mobikwik | Upto 2,00,000 INR |

| Bharatpe (Business loan) | Upto 5,00,000 INR |

| Slice | Upto 1,00,000 INR |

| True Balance | Upto 50,000 INR |

| ZestMoney | Upto 2,00,000 INR |

| Amazon Pay Later | Upto 60,000 INR |

| Flipkart Pay Later | Upto 60,000 INR |

| TATA Neu App | Upto 10,00,000 INR |

| TATA neu Credit card | Upto 15,00,000 INR |

| Ola Money | Upto 20,000 INR |

| Khatabook Instant Loan | Upto 2,00,000 INR |

| SBI YONO APP | Upto 8,00,000 INR |

| Paisabazaar Personal Loan | Upto 40,00,000 INR |

| Jupiter Loan | Upto 50,000 INR |

| OneCard Loan | Upto 150,000 INR |

| IDFC First Bank Loan | Upto 60,000 INR |

| Bajaj Finserv | Upto 10,00,000 INR |

| FlexSalary Instant Loan | Upto 2,00,000 INR |

| Indialends | Upto 5,00,000 INR |

| IndusMobile | Upto 2,00,000 INR |

| InstaMoney Personal Loan | Upto 25000 INR |

| Fullerton India Loan | Upto 25,00,000 INR |

| PayMe India | Upto 2,00,000 INR |

| LoanTap | Upto 10,00,000 INR |

| Buddy Personal Loan | Upto 15,00,000 INR |

| StashFin | Upto 5,00,000 INR |

| Fibe | Upto 5,00,000 INR |

| CashBean | Upto 60,000 INR |

| SmartCoin | Upto 1,00,000 INR |

| mPokket | Upto 30,000 INR |

| Branch Personal Loan App | Upto 50,000 INR |

| FlexSalary Instant Loan | Upto 2,00,000 INR |

| Money View | Upto 5,00,000 INR |

| SmartCoin | Upto 25,000 INR |

| PayMe India | Upto 2,00,000 INR |

| Realme PaySa | Upto 10,00,000 INR |

| RupeeLend | Upto 1,00,000 INR |

| Bueno Loans | Upto 25,000 INR |

| Loaney | Upto 20,000 INR |

Top 5 Recommended RBI Approved Loan Apps in India

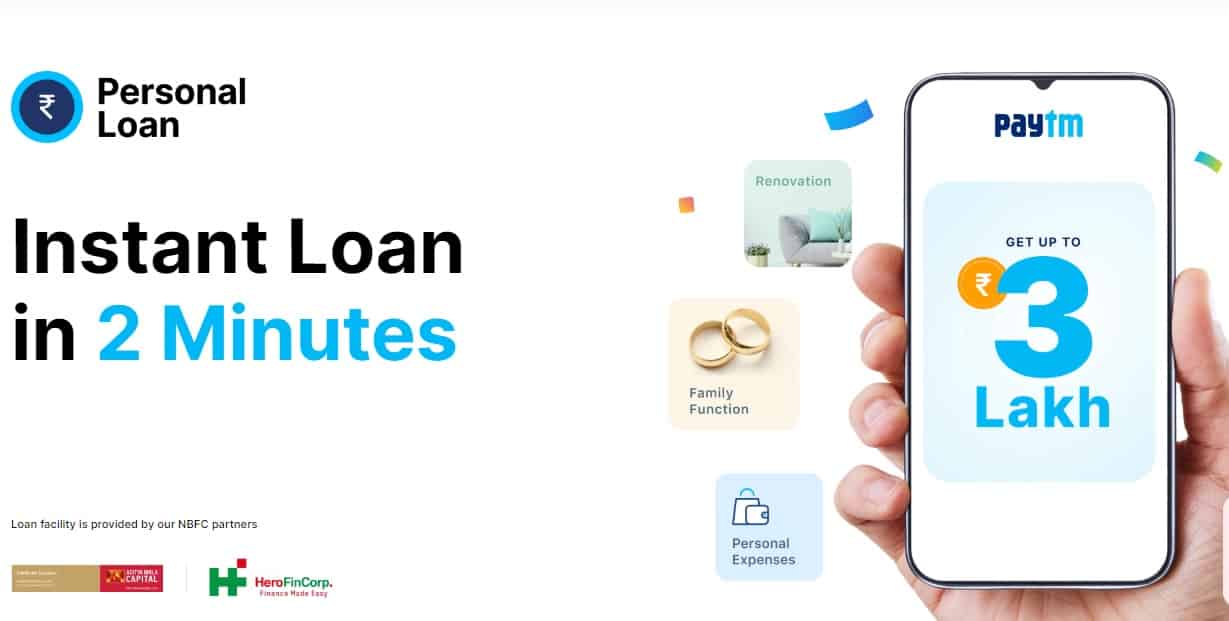

1. Paytm

Paytm is India’s one of the most Biggest digital payment and Financial Services Companies. In collaboration with Aditya Birla Capital and Hero Fincorp, Paytm offers Instant Loans with a maximum limit of ₹3 lakhs.

You can avail of the Paytm Personal Loan 24×7 from your Mobile Phone without any paperwork. You can convert their loan Into Flexible EMI, making the loan repayment more effortless.

However, the Age Eligibility criteria for the Paytm Personal Laon is 23-60 years. You can check loan eligibility by searching for “Personal Loan” on Paytm App. Once It shows the eligibility, Enter Your PAN Number, Get your Loan Offer, and at last Share Your Bank Account Number and Receive the amount. Learn More about Paytm personal loan Here.

Features of Paytm Personal Loan

- Maximum Loan Amount: 3,00,000

- 24×7 Availability

- Helps to Improve Credit Score

- Flexible Loan Tenure

- Easy EMI Loan Repayment

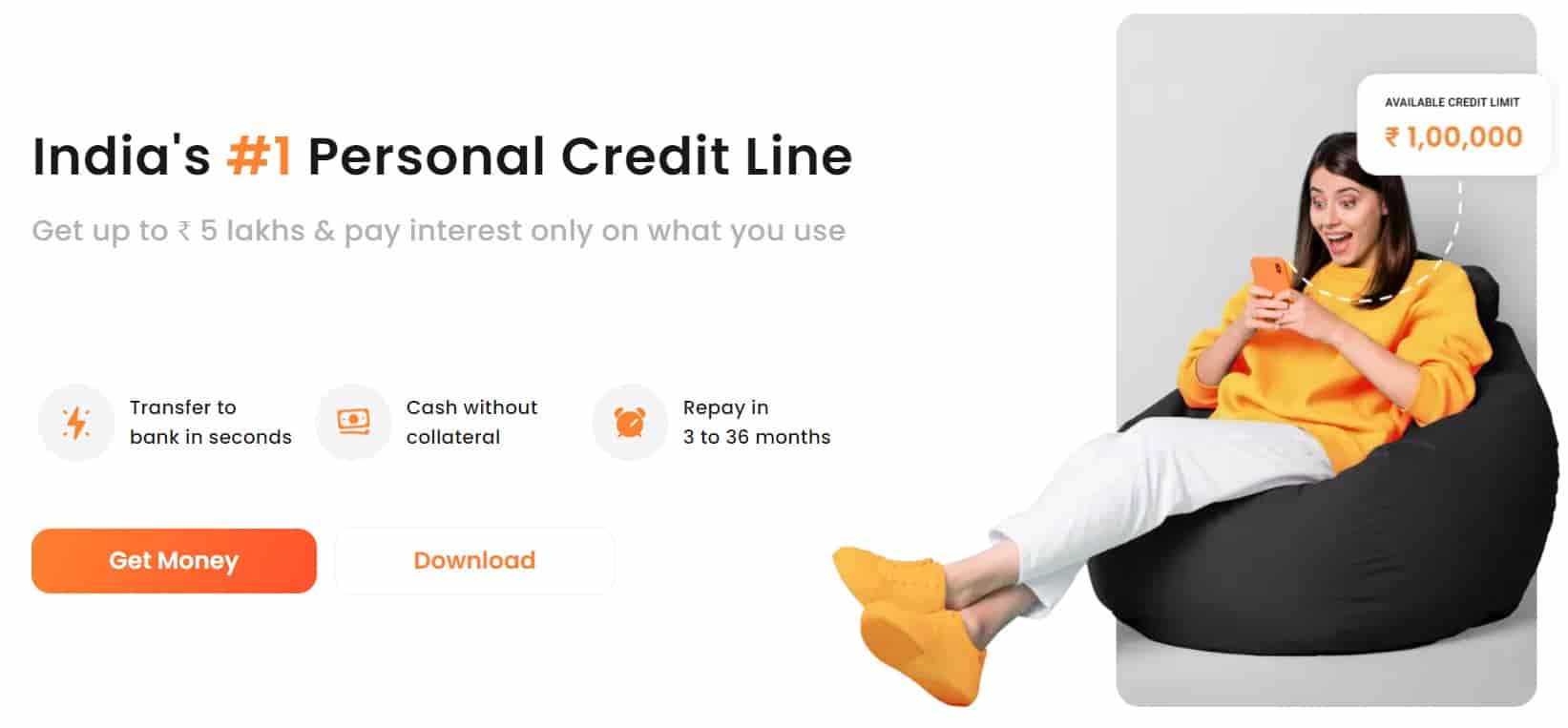

2. Money Tap

Started in the Year 2016, Money Tap is a Fintech startup based out of Bangalore. MoneyTap has partnered with various financial institutions and banks to offer Loans to customers.

MoneyTap offers loans up to 5 Lakh Rupees which Can be Paid in Easy EMI in 3 to 36 months. One of the highlighted features of Money Tap Personal Loan is You only Pay the Interest amount on what You have Spent.

Features of Money Tap Personal Loan

- Get a Loan of up to 5 Lakh Rupees.

- Easy Repayment of Loan in EMI.

- Lifetime access to credit

- No collateral, no guarantors Required.

- Interest Rate of 1.25% per month

3. Navi

Navi is a Personal Loan app that offers Home Loan Upto 5 crore and Cash loans up to 20 Lakh Rupees. Borrowers can Receive the funds directly into their bank account with zero paperwork. With the Flexible Easy EMI option of up to 6 years or 72 months, You can pay off your loan stress-free.

With Minimal Documents and No Collateral, Navi is a great option to take a Personal Loan. The eligibility criteria for the Navi app Personal Loan are Mentioned Below.

- Indian Citizen with Age of 21 – 65.

- Aadhaar Card and PAN card.

- Salaried or self-employed with Annual income > 3 Lakh.

- CIBIL score greater than 750

4. Dhani Personal Loan

Indiabulls Consumer Finance Limited, Dhani app is a financial services app offering services including Online Shopping, Bill Payment, UPI, Stock trading, and More. Getting a Personal loan through the Dahani app is simple and Effortless.

With minimal paperwork and a reasonable Processing Fee, You can get a Loan of up to ₹15 Lakhs from Dhani App. However, there are some eligibility criteria to get the loan which are Mentioned Below.

- Borrower Must be Age of 21+

- Borrower Must be a citizen of India.

- He or She Should be employed or self-employed.

- Borrower Must have Aadhar and PAN for KYC

5. Paysense

Paysense is a Mumbai-based Financial services Startup established in the Year 2015. Backed by some of the Biggest Financial Institutions including IDFC First Bank, Payu Financce, SMFG India Credit, and Credit saison India, Paysense Offers Personal Loans up to ₹5 Lakhs in just three simple steps.

Features of Paysense Loan

- Instant personal loans up to 5 Lakh.

- Affordable EMI repayment of Loans.

- No Credit History is required.

- Minimal Paperwork with quick approval.

How to Apply for a Personal Loan through App?

- Download the App From Your Android and IOS App Store.

- Open the App and Register with Your Mobile Number or Email Address.

- Complete the KYC Process by Uploading Documents like Your Aadhar, PAN, and Selfie.

- Upload Other Necessary Documents which include Bank Account Number, Salary Slip, and Bank Account Statement.

- Next, the Lender will verify all the details and check if You meet the eligibility criteria.

- Upon getting approval, Choose Loan Amount and Tenure.

- Money will be Transferred to Your Bank Account within a few minutes.

Eligibility Criteria for Payments Personal Loan

- The Borrower should be a Resident of India.

- Age: 21 years to 60 years

- A salaried Person should have a Monthly income of a minimum ₹18,000.

- Self-employed persons should have a monthly income of a Minimum ₹20,000.

Important Things to Know Before Getting a Loan

Before Getting any loan from these RBI approved loan apps in India, It is important to understand the terms, conditions, and implications of the loan. Here are some important things to consider when taking Loan.

Interest Rates: Many financial institutions Advertises their Services by saying that they offer Loan at zero percentage Interest Rate. However, many hidden fees can add to the overall cost of borrowing.

Loan Repayment Terms: Always review the Loan repayment Terms which Include the Loan tenure and monthly EMI. Make sure to keep the Loan tenure short to avoid Extra Interest rates.

Processing Fees: Make sure to inquire about if there are any processing fees associated with the loan application. Understanding the Processing Fees will Help to Know the exact about of borrowing.

Privacy Policy: A Privacy Policy is a Legal file that summarizes how an agency may be Storing, Processing, sharing, and using the Data of individuals. While taking Loans, We share Many Important records Like our Aadhar Number, PAN Number, and Signature. It is important to Know how the organization handles your personal and financial statistics.

Frequently Asked Questions (FAQ)

Which loan apps are verified by RBI?

How do I know if my loan app is RBI approved?

Is the loan app legal or not?

Which loan apps are frauds?

How many loan apps are banned in India?

Is cashe registered with RBI?

Is Payrupik RBI registered?

Is KreditBee approved by RBI?

Is KreditBee a Chinese app?

Is Dhani approved by RBI?

Is Buddy loan RBI approved?

Is the Navi loan app safe?

Is the MoneyTap app safe?

In Conclusion

As our Indian economy Continues to Grow, Fintech Startups Play an Important role in providing convenient Financial solutions to Businesses and Individuals. The rise of Quick Loan apps in India has played an important role in making formal credit available to Indians.

Gone are the days when we had to visit Banks, Stand in Long queues for Hours for Loan Approvals. Borrowers can Now apply for loans using their Mobile phones without any hassle. The entire process, from approval application, can be completed within minutes, which eliminates the Lengthy paperwork and Documentation.

Compare to Traditional banks, Quick loan Apps have relaxed eligibility criteria. Thanks to their less stringent credit requirements, People with Poor Credit scores can also apply for Loans through these apps. Moreover, for anyone who has no credit history, these apps can also help them build a Positive credit Score.

We Hope this Article Answers all Your queries about RBI approved loan apps in India. If You have any other questions or Suggestions, Please feel to share them with us in the Comments Section below.